The U.S. housing market is on the verge of an exciting phase as we approach 2025. With key factors such as potential interest rate drops, shifting demographics, and increased new construction, many experts are predicting a housing boom. Whether you’re a prospective buyer, real estate investor, or industry professional, here are the top 7 must-know facts about what’s coming.

1. Interest Rates Could Drop Below 5%—Get Ready for More Buyers

Interest rates have been hovering around 6%, a noticeable increase compared to the historically low rates we saw during the pandemic. However, when we take a step back, today’s rates are still much lower than the 15%+ highs seen in the 1980s. In fact, according to the Mortgage Bankers Association (MBA), we might see interest rates drop below 5% by 2025.

Source: Bankrate

What does this mean? Lower interest rates make mortgages more affordable, which will attract more buyers. Home affordability and access to better financing options will fuel a surge in demand, leading to increased home sales across the board.

2. Demographic Shifts: Millennials, Gen Z, and Baby Boomers in Play

A significant demographic shift is also playing a major role in shaping the housing market. Millennials, currently aged 27 to 42, are now in their prime home-buying years, and their impact is undeniable—they accounted for 43% of homebuyers in 2022. Many of them are looking for not just starter homes but upgraded properties as their families expand.

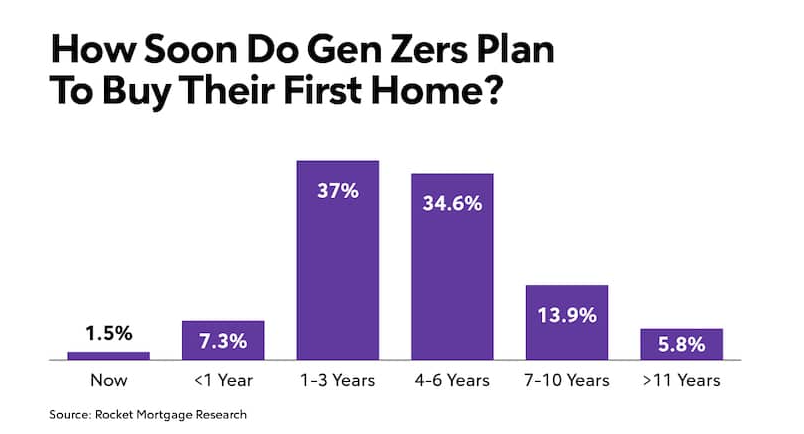

Meanwhile, Gen Z is quickly catching up. Surveys show that 72% of Gen Z individuals plan to buy a home within the next five years. This younger generation’s entry into the market, combined with Baby Boomers looking to downsize or relocate, is set to create a perfect storm of housing demand.

3. The American Dream of Homeownership is Still Alive

Despite economic uncertainty and fluctuating markets, the desire to own a home remains strong in the U.S. A recent study revealed that 75% of Americans view homeownership as a key part of achieving financial success. Furthermore, 87% of buyers see purchasing a home as a way to build long-term wealth.

This resilience suggests that even in tough market conditions, people are motivated to buy—ensuring a steady demand for housing in the coming years.

4. Expanded Mortgage Programs Open Doors for More Buyers

The availability of expanded mortgage programs is providing more opportunities for a wider range of buyers. Programs like FHA loans, which require smaller down payments, VA loans for veterans, and USDA loans for rural buyers are helping more people realize their dream of homeownership.

With these flexible options, buyers from various backgrounds will be able to enter the housing market, boosting overall activity and demand.

5. New Construction is Booming

One of the ongoing challenges in the housing market has been limited inventory, but that’s about to change. Builders are responding to the increased demand with an uptick in new construction. In 2024 alone, 1.5 million new homes are expected to be completed, and this number will rise to 1.7 million in 2025 and 1.8 million in 2026.

According to Freddie Mac, the U.S. could be producing 2 million new homes annually by 2028. This wave of new construction will help address the current supply shortage and offer more options for buyers across various price points.

6. Projected Home Sales Growth: A Steady Climb

As mortgage rates decline and demand increases, home sales are expected to see steady growth over the next several years. Here’s a look at the projected home sales numbers:

- 2024: 4.2 – 4.48 million homes sold

- 2025: 4.5 – 4.75 million homes sold

- 2026: 4.8 – 5 million homes sold

- 2027: 5.1 – 5.25 million homes sold

- 2028: 5.3 – 5.5 million homes sold

This sustained growth in home sales will have widespread implications for the real estate industry, from brokers to lenders and developers.

7. Commission Growth: More Sales, More Income

Increased home sales will directly translate into more commission income for real estate professionals. Based on a 5-6% average commission rate, total commission earnings are projected to rise steadily:

- 2024: $240 – $268 billion

- 2025: $255 – $285 billion

- 2026: $270 – $300 billion

- 2027: $285 – $315 billion

- 2028: $300 – $330 billion

As sales volume increases, real estate agents, brokers, and firms can expect significant revenue growth over the next five years.

In Conclusion: The 2025 Housing Market is Heating Up

With interest rates projected to drop, demographic shifts fueling demand, and new construction on the rise, the housing market is poised for a boom by 2025. Buyers will have more opportunities thanks to expanded mortgage programs, and real estate professionals will benefit from increased sales and commissions. If you’re in the market, whether as a buyer, seller, or investor, the next few years present exciting opportunities to capitalize on the growing housing momentum.