4 Income Streams Through Rental Properties: Maximizing Your Investment

What if I told you that one type of investment could generate four different streams of income? When it comes to rental properties, this isn’t just a possibility—it’s the reality. Real estate is one of the most versatile investment vehicles, offering multiple avenues for wealth creation. In this article, we’ll explore the four key income streams that rental properties can provide: appreciation, cash flow, depreciation, and principal reduction. Understanding these can help you unlock the full potential of your investment.

1. Appreciation: Watch Your Property Value Grow

Definition: Appreciation is the increase in the value of a property over time, driven by factors like market demand, economic conditions, and property improvements.

How It Works:

- Market Growth: As real estate markets expand, property values tend to rise. This can be due to factors like population growth, development in the area, or rising demand for housing.

- Forced Appreciation: Strategic improvements to your property, such as renovations or upgrades, can further increase its value beyond natural market appreciation.

Example: Imagine you purchase a rental property for $250,000 in an up-and-coming neighborhood. Over the next five years, the area develops, attracting more residents and businesses. As a result, your property’s value increases to $350,000. This $100,000 appreciation adds directly to your net worth, providing a significant return on your initial investment.

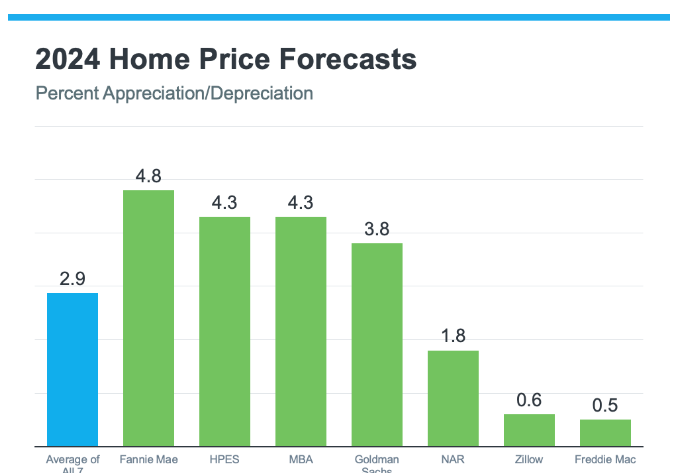

Home prices are forecasted to rise at a more normal pace here at New Hampshire. The graph below shows the latest forecasts from seven of the most trusted sources in the industry:

Source: newhampshiremainerealestate.com

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains: “One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

2. Cash Flow: Steady Income from Rental Payments

Definition: Cash flow is the net income you receive from your rental property after deducting all expenses, including mortgage payments, maintenance costs, insurance, and property taxes.

How It Works:

- Rental Income: Each month, your tenants pay rent, which is your primary source of income from the property.

- Expense Management: To maximize cash flow, it’s crucial to manage your expenses effectively, ensuring that your rental income exceeds your costs

Example: Suppose your rental property generates $2,500 in rent each month. After deducting $1,500 for the mortgage, $200 for maintenance, $150 for insurance, and $150 for taxes, you’re left with $500 in positive cash flow. This $500 is your profit, providing a consistent income stream that can be reinvested or saved.

3. Depreciation: A Powerful Tax Advantage

Definition: Depreciation allows property owners to deduct the costs of wear and tear on their rental property from their taxable income, even though the property may actually be appreciating in value.

How It Works:

- Tax Deductions: The IRS allows you to depreciate the value of the building (but not the land) over 27.5 years for residential properties, which can reduce your taxable rental income. Commercial property can be depreciated over a 39-year straight line, while residential property can be depreciated over a 27.5-year straight line.

- Offsetting Income: Depreciation is a non-cash expense, meaning it doesn’t cost you out of pocket, but it can still significantly lower your tax bill.

Example: If the building portion of your rental property is valued at $275,000, you can claim a depreciation deduction of approximately $10,000 each year ($275,000 / 27.5 years). This deduction reduces your taxable income, potentially saving you thousands of dollars annually, making your investment even more profitable.

4. Principal Reduction: Building Equity Through Tenant Payments

Definition: Principal reduction occurs when a portion of your mortgage payment goes toward paying down the loan’s principal balance, increasing your equity in the property.

How It Works:

- Mortgage Payments: Each mortgage payment includes interest and principal. Over time, the portion allocated to the principal increases, steadily building your equity.

- Tenant Contributions: The rent paid by your tenants often covers your mortgage payments, meaning they’re effectively helping you pay down the loan and build equity.

- Equity Growth: As the principal balance decreases, your ownership stake—or equity—in the property increases. This builds your wealth over time without requiring additional cash outlays.

Example: Let’s say your monthly mortgage payment is $1,500, with $500 going toward the principal. Over a year, this results in $6,000 of principal reduction. Since your tenants’ rent payments cover the mortgage, they’re indirectly helping you pay off the property, increasing your equity and future net worth.

Maximizing Returns with Rental Properties

Rental properties are more than just a source of monthly income—they are a multifaceted investment that can generate wealth in four distinct ways. By understanding and leveraging appreciation, cash flow, depreciation, and principal reduction, you can maximize the returns on your real estate investments.

Whether you’re a seasoned investor or just getting started, rental properties offer a compelling opportunity to grow your wealth, secure your financial future, and enjoy the benefits of a diversified income stream. So, when considering where to invest, remember that rental properties don’t just provide shelter—they provide a pathway to financial freedom.

Interested in learning how to “Force Appreciation?” – Check out our in-depth guide below