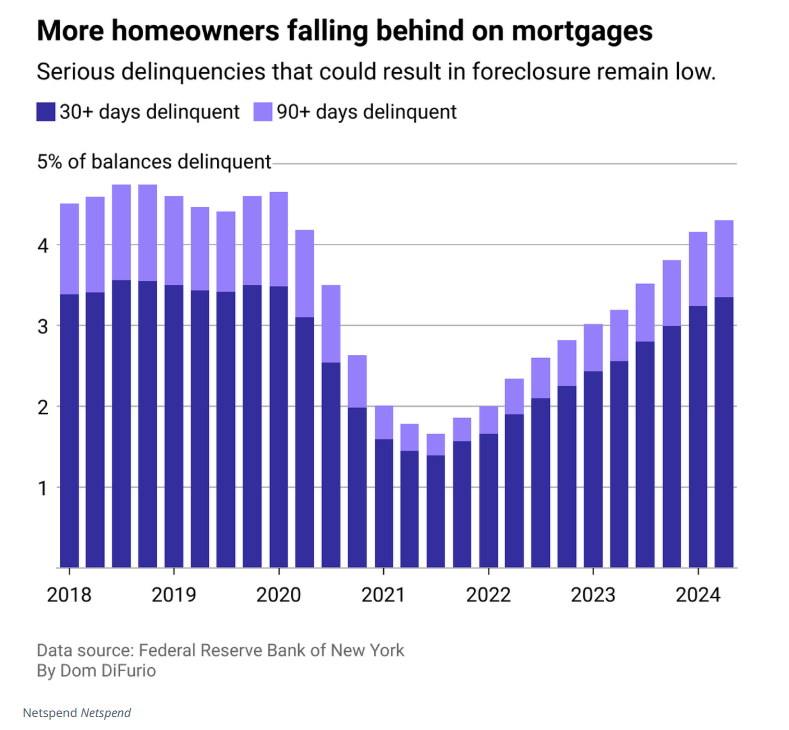

Mortgage delinquencies have been climbing steadily, approaching levels not seen since before the pandemic. According to data from the Federal Reserve Bank of New York, more homeowners are falling behind on payments, a trend that began in 2021. While these early signs don’t yet signal a foreclosure crisis, they do highlight potential economic challenges ahead.

As shown in the chart above, serious delinquencies—defined as being 90 or more days past due—remain relatively low. However, the share of homeowners who are at least 30 days behind on their payments has been rising. This shift underscores growing financial stress for some borrowers, even though overall balances at risk of foreclosure remain modest.

A Closer Look at the Data

The term “delinquent” applies when a homeowner misses at least one mortgage payment. Over the past few years, early-stage delinquencies (30 to 90 days late) have increased, though longer-term delinquencies have yet to rise significantly. Lenders have not yet seen a notable uptick in homeowners missing three or more payments, which is when foreclosure proceedings often begin. However, this trend could serve as an early warning sign of a shifting economic landscape, according to the Consumer Financial Protection Bureau (CFPB), which tracks housing market health.

Who’s Feeling the Pressure?

Federal Housing Administration (FHA) loans are experiencing the highest rates of delinquencies, followed by loans backed by the Department of Veterans Affairs (VA). Analysts at the Mortgage Bankers Association (MBA) attribute this trend to the expiration of pandemic-era relief programs. Many homeowners who previously benefited from mortgage forbearance programs or other temporary assistance are now navigating the repayment landscape on their own.

Even with these challenges, lenders are offering alternatives to foreclosure. Programs are being implemented to help borrowers stay in their homes by restructuring loans or providing payment assistance. Additionally, the CFPB has proposed new rules that would require lenders to pause foreclosure proceedings if a borrower requests help, ensuring that homeowners have the chance to explore all available options.

How Does This Compare to Previous Crises?

During the 2007–2010 housing crisis, mortgage delinquencies soared, with nearly 9% of homeowners facing serious delinquency. Today, that figure is below 1%, thanks in part to lower interest rates and proactive policies during the pandemic. According to the MBA, delinquencies are still low by historical standards, but the recent increase is linked to a rising unemployment rate—a key factor that has historically impacted mortgage performance.

The second quarter of 2024 saw 47,000 new foreclosures reported—a significant drop from the 75,000 recorded in the same period in 2018. However, with the nationwide unemployment rate creeping past 4%, economists remain cautious. A further rise in unemployment could lead to more homeowners struggling to keep up with their mortgage payments, especially as interest rates continue to climb.

Homeowners Remain Resilient—for Now

Despite the economic pressures, most homeowners are holding steady, largely due to the advantage of locking in low-interest rates during the pandemic. By 2023, nearly 80% of mortgage holders had interest rates below 5%, and almost 60% were paying less than 4%. These low rates provide some financial cushion, helping homeowners weather rising costs elsewhere.

What’s Next?

While foreclosures remain historically low, the landscape could shift if economic conditions worsen. Homeowners facing difficulty should reach out to their lenders early to explore options, including loan modifications or other assistance programs. Staying informed and proactive can make the difference between keeping a home and facing foreclosure.

For now, the housing market is in a delicate balance. Rising delinquencies are a sign worth watching, but strong fundamentals—such as low interest rates for many homeowners—continue to provide a buffer against widespread instability.