How DSCR Loans Work: Understanding the Math and Typical Rates

Debt Service Coverage Ratio (DSCR) loans are a crucial financing option for real estate investors and business owners. These loans are primarily used for income-producing properties, where the borrower’s ability to repay the loan is assessed based on the property’s cash flow rather than personal income. Let’s dive into the mechanics of DSCR loans, the mathematical calculations involved, and the typical rates associated with these loans.

What is DSCR?

The Debt Service Coverage Ratio (DSCR) is a financial metric used by lenders to evaluate the cash flow of an income-producing property to determine if it generates enough revenue to cover its debt obligations. The DSCR is calculated using the following formula:

- Net Operating Income (NOI): The total income generated from the property after deducting operating expenses but before deducting taxes and interest.

- Total Debt Service (TDS): The total amount of debt obligations, including principal and interest payments, that must be paid over a specific period.

DSCR Calculation Example

Let’s consider a commercial property with the following financials:

- Gross Rental Income: $150,000

- Operating Expenses: $50,000

- Annual Debt Payments (TDS): $60,000

First, we calculate the Net Operating Income (NOI):

Next, we calculate the DSCR:

A DSCR of 1.67 means that the property generates 1.67 times more income than is required to cover its debt obligations, which indicates a healthy cash flow and a lower risk for lenders.

Current DSCR Loan Interest Rates

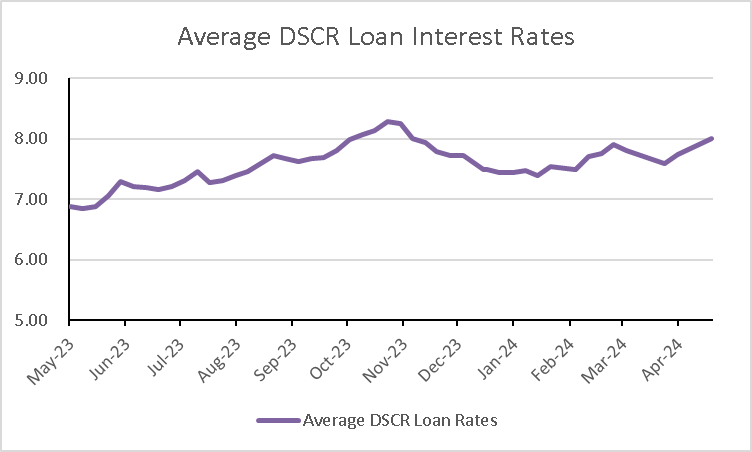

As of Apr 22, 2024, the starting average DSCR loan interest rate is 8%, given the ideal lending conditions, such as a good DSCR ratio, favorable LTV, and strong credit score. This rate is just the baseline, and your exact interest rate could be higher or lower depending on your financial profile and lender.

Source: HomeAbroad

This average DSCR loan interest rate is a general estimation based on 30-year fixed conventional mortgage rates. Typically, DSCR loan rates are 1%- 1.5% higher than conventional mortgage rates due to the unique nature of DSCR loans and the associated increased risk for the lender.

Key Terms

- Loan-to-Value Ratio (LTV): Lenders often require a specific LTV ratio in addition to DSCR. A typical LTV ratio for DSCR loans ranges from 70% to 85%.

- Prepayment Penalties: Some DSCR loans may come with prepayment penalties, which borrowers should consider when planning their exit strategy.

- Loan Term: The loan term can impact the DSCR calculation. Shorter terms might require higher DSCR to ensure adequate cash flow.

- Economic Conditions: Interest rates for DSCR loans can fluctuate based on market conditions and economic factors.

Take-Away

DSCR loans offer a practical financing solution for investors and business owners who have income-producing properties. Understanding the math behind DSCR and the typical rates associated with these loans can help borrowers make informed decisions and secure the best possible financing for their investments. By maintaining a strong DSCR and staying informed about market trends, borrowers can optimize their loan terms and achieve their investment goals.